Bankruptcy: To Fear or Not to Fear

While I often feel like sarcastically quoting this after paying $7 for a Starbucks coffee, bankruptcy is not an ordinary, everyday occurrence. Nor should it be, as it’s not something to take lightly in business or personal finances. However, this debt-relieving legal process can give individuals a “fresh start,” especially if they’re burdened with heavy outstanding balances and have exhausted other repayment options. But it’s not without its tradeoffs.

What is Bankruptcy?

Growing up, I thought bankruptcy was equivalent to pounding a big you’re-financially-done-for-forever stamp on someone’s forehead. And while bankruptcy can result from poor financial decisions, failed businesses, loss of income, and so on, the process itself is not always a bad thing, contrary to popular belief. In fact, it can be the exact opposite.

But before we dive into that, what exactly is bankruptcy?

Bankruptcy is a legal proceeding designed to help businesses and individuals who cannot repay their debts.

People file for bankruptcy because qualifying debtors can create a repayment plan or eliminate the obligation to repay outstanding balances, essentially getting a “clean slate” in terms of debt. Additionally, as soon as you file for bankruptcy, credits are prohibited from attempting to collect payments because the court orders an “automatic stay.” That means no more berating calls, letters, or threats of lawsuits!

Bankruptcy can assist with a wide range of secured and unsecured debts, such as credit card debt, medical bills, personal loans, utility bills, and payday loans.

However, let’s note right off the bat that some debts can’t be discharged (a fancy word for “eliminated”) with bankruptcy. For example, child support, alimony, fines, penalties, and most tax debts are considered non-dischargeable. And sorry in advance to all the college kids reading this, but typically, student loans are off the table too; however, it’s not impossible to qualify. Individuals must complete an additional filing process called “adversary proceeding,” to get federal student loans discharged, where they prove the debt would cause an “undue hardship.”

Are There Different Types of Bankruptcy?

The United States Bankruptcy Code contains six types of bankruptcy, referred to as “chapters,” numbered 7, 9, 11, 12, 13, and 15. Super thrilling names, right (sarcasm)? Each chapter is designed for specific users and contains different eligibility requirements and rules, such as income levels and limits on debt repayment totals. Here’s a brief overview of each chapter categorization:

Chapter 7 – Liquidation

Chapter 9 – Municipalities

Chapter 11 – Large reorganization

Chapter 12 – Family farmers

Chapter 13 – Repayment

Chapter 15 – Foreign cases

In this blog, we’ll focus on Chapter 7 and Chapter 13 since they are the most commonly filed and can greatly benefit individuals and families. But for those dying to learn about the other four chapters, you can read all about them here; and to discover each chapter’s requirements, refer to the United States Courts website.

What is Chapter 7 Bankruptcy?

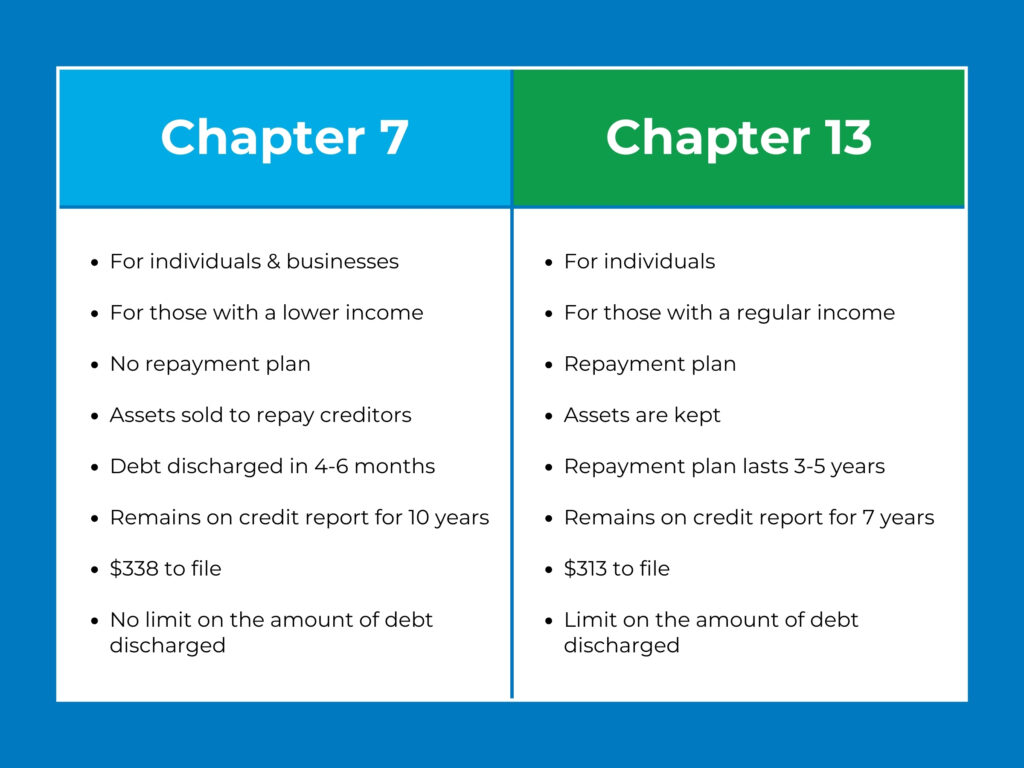

The most common form of bankruptcy in the United States is Chapter 7, also known as straight or liquidation bankruptcy. This option wipes out debt in four to six months, which is extremely fast compared to other repayment or debt-eliminating options.

Available to individuals and businesses, Chapter 7 generally works to discharge what is owed on unsecured debt, such as credit card debt, unsecured personal loans, and medical bills. This is done by converting non-exempt assets to cash to repay creditors. In other words – you gotta sell your stuff to repay some of what you owe. Don’t worry, though, you don’t have to sell everything you own. There are protections in place that allow you to keep particular possessions referred to as exempt assets.

Exempt and nonexempt assets are determined by the federal government or the state where you reside. Each state determines whether an individual must adhere to state exemptions or if they can decide between the state and federal exemption lists.

Typical non-exempt assets include things like a second car or home, collectables, jewelry, luxury items, stocks and bonds, and cash. So, if you file, prepare to say goodbye to your coin collection and vacation house in Florida.

Typical exempt assets include your primary vehicle and home, retirement accounts, necessary home goods, and clothing. However, if you have a large amount of home equity or are extremely behind on mortgage payments, it is possible you could lose your home through Chapter 7.

Under Chapter 7 bankruptcy, secured debt such as home and car loans can remain in the owners’ possession, but borrowers must make proper payments to keep those assets. If they don’t, those items are surrendered to the lender. Unfortunately for businesses, the necessary liquidation of assets through Chapter 7 makes most companies unable to function, consequently shutting them down.

While assets play a significant role in Chapter 7, there are situations referred to as ”no-asset cases” in which debtors have no available or nonexempt assets to pay creditors. In this case, debt is still discharged, but creditors receive no money.

To determine eligibility for Chapter 7 bankruptcy, most filers must take the “means test.” Don’t worry, you don’t have to do any studying. Instead, the means test is a calculation that proves you need to file. If your income is less than the median income for your family size in your area, you’re likely to qualify for Chapter 7. If not, your next best bet is Chapter 13 bankruptcy. This option also uses the means test but is helpful for those whose income enables them to repay debt, unlike those who commonly file for Chapter 7.

What is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy, also known as a wage earner’s plan, is designed for individuals only. This option commonly attracts those with an income too high to qualify for Chapter 7 and those who don’t want to lose their assets. Unlike Chapter 7, the presence of a repayment term means filers don’t have to surrender possessions to repay creditors.

Those who qualify can build a repayment plan to pay off all or part of their debt within a specific period, usually three to five years, depending on their income:

- Three-year plan = Current monthly income < applicable state median

- Five-year plan = Current monthly income > applicable state media

Any remaining debt is discharged at the end of the repayment plan period. Yay! However, under Chapter 13, no more than $2,750,000 in combined secured and unsecured debt can be discharged.

One requirement to qualify for Chapter 13 is that individuals prove they have sufficient regular income to make the required payments on a timely basis. This is where that good ol’ means test comes in again! This requirement typically makes it more challenging for individuals to qualify for Chapter 13 than Chapter 7.

Under Chapter 13, if a debtor misses a payment, the trustee distributing their payments to creditors can file to dismiss their case, convert it to Chapter 7, or modify the plan.

What is Bad About Bankruptcy?

“Bankruptcy seems pretty useful so far! What’s the catch?”

Unfortunately, it’s not all sunshine and rainbows. In addition to downsides like the potential loss of assets seen in Chapter 7, there are other unfavorable consequences of bankruptcy.

1. It’s harmful to credit scores

Bankruptcy is BRUTAL on your credit score, a number that signifies your reputation for repaying debt to lenders. Dropping scores anywhere from 100-200 points, bankruptcy leaves a stain on your credit report that can last for 7 to 10 years, depending on the type of chapter filed *gulp.*

“So, my score goes down. What’s the big deal?”

A low credit score can make it incredibly difficult to:

- Find employment and housing

- Access affordable insurance

- Avoid expensive high interest rates

- Qualify for car and home loans

- Get utilities

- Get large cash deposits

- Add authorized users to credit cards

- And more

And say you do qualify for loans and mortgages, you’ll have much worse rates than individuals with good scores, costing you more money.

However, bankruptcy is designed to improve your credit score in the long run. Your debt-to-income ratio improves once your debts are discharged, effectively giving you a fresh start to rebuild your credit. The impact bankruptcy has on your credit score and how long it takes to recover is circumstantial, but be extremely cautious of these adverse effects and their impact on your financial abilities.

2. It’s expensive to file

This may seem counterintuitive, but it will cost you a pretty penny to file for bankruptcy. You’ll have to chalk up $338 for Chapter 7 and $313 for Chapter 13 bankruptcy to help cover expenses such as legal, filing, and accounting fees.

Additionally, while a bankruptcy attorney is not required by law, hiring professional assistance is an extremely wise decision. They can save you time and stress, ensuring you file correctly with all the necessary paperwork and drastically decreasing your chances of getting rejected for incorrect information. Not to mention that the idea of sorting out all the legalities and complex paperwork alone can sound like your own personal hell. So, this is another expense to consider.

Also, all individual bankruptcy filers must complete pre-bankruptcy credit counseling and pre-discharge debtor education from organizations and course providers approved by the U.S. Trustee Program, adding another expense to the bankruptcy process. A certificate of completion for both is required before debt can be discharged.

3. Bankruptcy Does Not Remove All Debt

As previously mentioned, some debts simply cannot be discharged with bankruptcy, including most tax debts, child support, fines, penalties, and student loans. Additionally, if you fall into more debt after your first bankruptcy, you must wait anywhere from two to eight years to file again, depending on what chapter you filed previously and want to file for now.

4. It’s Emotionally Challenging

Whether you’re considering it, in the process, or have completed it, the stigma surrounding bankruptcy can lead to shame or embarrassment. Additionally, the misinformed opinions of people who don’t understand bankruptcy can hurt or lead you to question your choices.

However, overcoming those negative perceptions can help you avoid enduring even more difficult years burdened by overwhelming debt. Remember: bankruptcy was created to help people and is a legal right.

Let’s put it in perspective…

If I am drowning and someone throws me a life preserver, I’m not going to say, “Oh my gosh, I can’t believe I’m drowning right now. That’s so embarrassing,” and then sink further away from the help.

No way!

I’m going to grab onto the available support because it will save me from a whole lot of pain and suffering!

There is no shame in wanting to fix your financial situation. You should be proud of yourself for seeking help and learning from your past, so stay strong when challenging emotions come your way.

When Should I File For Bankruptcy?

The presence of debt doesn’t automatically mean you should file for bankruptcy. While “debt” has a justified negative connotation, it’s essential to recognize that not all debt is cause for immediate drastic measures.

Hear me out…

You can consider borrowed money that increases your net worth or acts as a wise investment as “good” debt. When used responsibly, student loans, mortgages, and business loans would fall under this category. For example, student loans allow you to get a good education, making it easier to get more job opportunities, which can eventually land you with a high-paying job you love. There is an eventual payoff that can benefit your future.

On the flip side, “bad” debt has high interest rates and requires payments that don’t easily mesh with your budget or perspective life plans. For example, this may include debt from credit cards or payday loans. This debt does more harm than good because it’s expensive and offers few positive consequences.

Generally, if you are unable to pay your debts off while adhering to a minimum standard of living, bankruptcy could be the right solution for you, especially if you cannot gain any leverage over these payments using other consolidation, refinancing, and repayment options. To put it bluntly, if you’re drowning in debt, facing lawsuits from creditors, and monthly payments are eating up an unsustainable amount of your income, take some serious time to consider bankruptcy. To further contemplate this option, ask yourself the following questions:

- What other debt-elimination methods have I tried?

- Do I want to keep certain assets?

- How much will it cost me to file?

- Are the debts I’m struggling with dischargeable?

- Is my debt truly so unmanageable that filing is justified?

There is no requirement on how much debt you have to have in order to file, but as a rule of thumb, it is probably not worth the fees and harm to your credit score unless you have at least $10,000 in dischargeable debt.

What Should I Try Before Filing For Bankruptcy?

Managing large amounts of debt is no easy task, often leaving individuals feeling hopeless and lost. Before you decide to file for bankruptcy, consider other options that may be better suited for your circumstances. Some examples of alternative financial solutions for bankruptcy include:

- Debt consolidation

- Negotiations with creditors

- Credit counseling

- Debt settlement

- Credit counseling

- Serious budgeting and saving adjustments

How 1166 FCU Can Help

Filing for bankruptcy is a big decision. Don’t make it alone. Contact our team for free financial counseling to discuss your options and see if filing is the right choice.

Contact Us: Browse our website for more information or contact us at 856-542-9241 to speak to a member of our team. You can also find 1166 on Social Media here:

Instagram: https://www.instagram.com/1166fcu/

Facebook: https://www.facebook.com/1166fcu.org

LinkedIn: https://www.linkedin.com/company/99499168/admin/feed/posts/

Twitter/X: https://twitter.com/1166FCU

Follow Us Today On:

Note from AC JosepH Media: If you like this story and others posted on Front Runner New Jersey.com, lend us a hand so we can keep producing articles like these for New Jersey and the world to see. Click on SUPPORT FRNJ and make a contribution that will go directly in making more stories like this available. Thank you for reading!