March Madness: Intro Into Mortgages

Move over, March Madness! It’s time for March Mortgages! As you craft your winning basketball bracket, practice your knowledge of game-changing mortgage options to help you find your homebuying champion!

What is a Mortgage?

A mortgage is a loan agreement between an individual and a lender over the purchase of property, typically a home, secured by the property as collateral. Simply put, you borrow money to purchase a home and pay it back with interest. If you don’t repay the lender, they can take back the property (talk about an airball).

What Types of Mortgage Loans Are There?

The type of mortgage you choose affects important financial aspects of the home-buying process, like the interest rate and down payment. But with so many options, how do you know what’s best for you? Not to worry, my home-buying friends! Come along as we unpack the five main types of mortgages: fixed-rate, adjustable-rate, conventional, government-backed, and jumbo loans.

Conforming Vs. Nonconforming Mortgage Loans

Before we become besties with our loan options, we need to cover conforming versus nonconforming loans. This will help us understand why certain mortgages function the way they do.

Conforming Loans

Conforming loans are the goody-two-shoes of mortgages. They follow the Federal Housing Finance Agency (FHFA) guidelines and, since they meet these standards, Government-Sponsored Enterprises (GSEs) can purchase these loans. Woah, woah, woah. GSEs? Purchasing loans? Let me introduce you to Frannie Mae and Freddie Mac – no, these aren’t the names of your sweet elderly neighbors down the street. They are two major GSEs in the homebuying world. The U.S. Congress created these enterprises to support the flow of credit by purchasing mortgages from lenders, keeping the housing market accessible and affordable. How nice!

Here’s how GSEs work: when you buy a home and get a mortgage, your lender can sell your loan to a GSE. The money from a GSE replenishes the lender’s funds, enabling them to issue more loans to other homebuyers. This cycle makes mortgages more accessible to those looking for a home due to the flow of monetary resources and reduced financial risk for lenders. Consequentially, this lender security often results in better terms and payment plans for borrowers.

It’s important to note that while Congress created GSEs, they are not fully government-backed like an FHA or VA loan. GSEs are government-sponsored, meaning they are made by Congress but privately owned. Therefore, the government doesn’t have to cover the losses if a borrower defaults on a loan purchased by a GSE. On the other hand, government-backed loans are insured by the government, protecting lenders from losses if the borrower defaults.

Typical Characteristics of Conforming Loans

- Lower interest rates

- Lower down payment

- Higher credit score required (typically 620 or higher)

- Debt-to-income (DTI) ratio must meet FHFA standards (typically around 36%)

- Less access to more expensive housing markets

- More lenders offer them

Nonconforming Loans

Nonconforming loans are the rebellious sibling of conforming loans. They do not follow FHFA guidelines, meaning GSEs will not purchase these loans from lenders. As a result, lenders have more flexibility in approving homebuyers since FHFA standards do not bind them, but they also take on more risk.

Typical Characteristics of Nonconforming Loans

- Higher interest rates

- Higher down payments

- Good for low credit scores

- Good for the more expensive housing market

- Easier to receive than conforming loans

- Less lenders offer them

Five Main Types of Mortgage Loans

1.) Fixed Rate

A fixed-rate loan has the same interest rate throughout its lifespan. That means you pay the same amount on your mortgage each month. This makes it super easy to budget for your mortgage, and that ease is evident in the fact that 92% of U.S. Households have fixed-rate mortgages. These mortgage loans can be conforming or nonconforming. When considering a fixed-rate mortgage, consider the rates in your area. If they are high, you may want to consider other options like an adjustable-rate mortgage.

Features of a fixed-rate mortgage

- Fixed monthly mortgage payments

- Typical repayment terms of 15 or 30 years

- Ideal for budgeting

- Good for low-interest-rate areas

2.) Adjustable Rate

An adjustable-rate mortgage (ARM), also known as a variable rate or floating mortgage, has payments that fluctuate over the loan’s lifespan. However, ARMs have a low-rate fixed period, typically the first 3, 5, or 7 years of the loan, in which the rate does not change. During this time, the rate could be lower than a typical fixed-rate mortgage. After this fixed period, the rate becomes variable and changes throughout the term.

Adjustable-rate mortgages can be conforming or nonconforming.

If the mortgage rates are low, you’re in luck. They may stay that way throughout the payment period. However, you risk the rates rising over time, increasing your monthly payments. On the other hand, if you don’t plan to stay in your new home for a long time, or you plan to pay off your mortgage quickly, you could benefit from the initial low-rate period ARMs provide.

Features of adjustable-rate mortgage

- Low initial interest rate

- The interest rate fluctuates after the initial fixed period

- Harder to budget for

3.) Conventional

While all conforming loans (which meet FHFA guidelines and are not backed by the government) are conventional mortgage loans (not backed by the government), not all conventional loans are conforming loans. Some conventional loans fall outside FHFA guidelines, so they cannot be classified as conforming loans even though the government does not back them. In summary, you’ll either have a conventional conforming loan or conventional nonconforming loan. Additionally, they can have fixed or adjustable rates.

Features of a conventional loan:

- A minimum credit score of 620 to qualify

- DTI ratio below 50%

- No Private Mortgage Insurance (PMI) required with a down payment of at least 20%

- With a PMI, the down payment could be as little as 3%-5%

- Typically better interest rates than government-backed loans

- Harder to qualify for than government-backed loans

4.) Government-Backed

Government-backed loans are nonconforming mortgage loans, and they are insured by government agencies rather than following FHFA guidelines. Examples include the Federal Housing Administration (FHA), Veterans Affairs (VA), and the United States Department of Agriculture (USDA).

FHA: Lower down payments, favorable for those with lower credit scores, accepts higher debt-to-income ratios, and offers a typically lower fixed interest rate. Popular with first-time homebuyers. FHAs have loan limits that narrow the housing market for those who use this option.

VA: Available to veterans, active-duty service members, and surviving spouses, with no down payment or minimum credit score required.

USDA: Designed for those within eligible suburban and rural areas, with no down payment or PMI requirement and relaxed credit requirements. USDA loans contain income restrictions to help lower-income buyers. While government-backed loans don’t follow FHFA guidelines, each option has its own eligibility criteria. However, these loans are generally easier to qualify for, especially if you’re a first-time buyer, compared to other options like conventional loans.

Click here to see FHA Loan Requirements

Click here to see VA Loan Requirements

Click here to see the USDA Requirements

5.) Jumbo Loans

Looking to buy a more expensive home? Invite me over for dinner sometime. Just kidding, maybe. Jumbo loans are nonconforming conventional loans typically used when purchasing a high value property that exceeds the conforming loan limit set by the FHFA.

Features of Jumbo Loans:

- Higher credit score required (typically above 700)

- Large down payment needed (around 20%)

- Lower DTI ratio

- Access to more expensive housing market

How Credit Scores Affect Mortgage Loans

If you think we forgot that it’s National Credit Education Month, think again! And it’s perfect timing since credit scores play a huge role in your mortgage loans. The higher the score, the more trustworthy you are to lenders. The more trustworthy you are, the better terms and rates your lender will be willing to give.

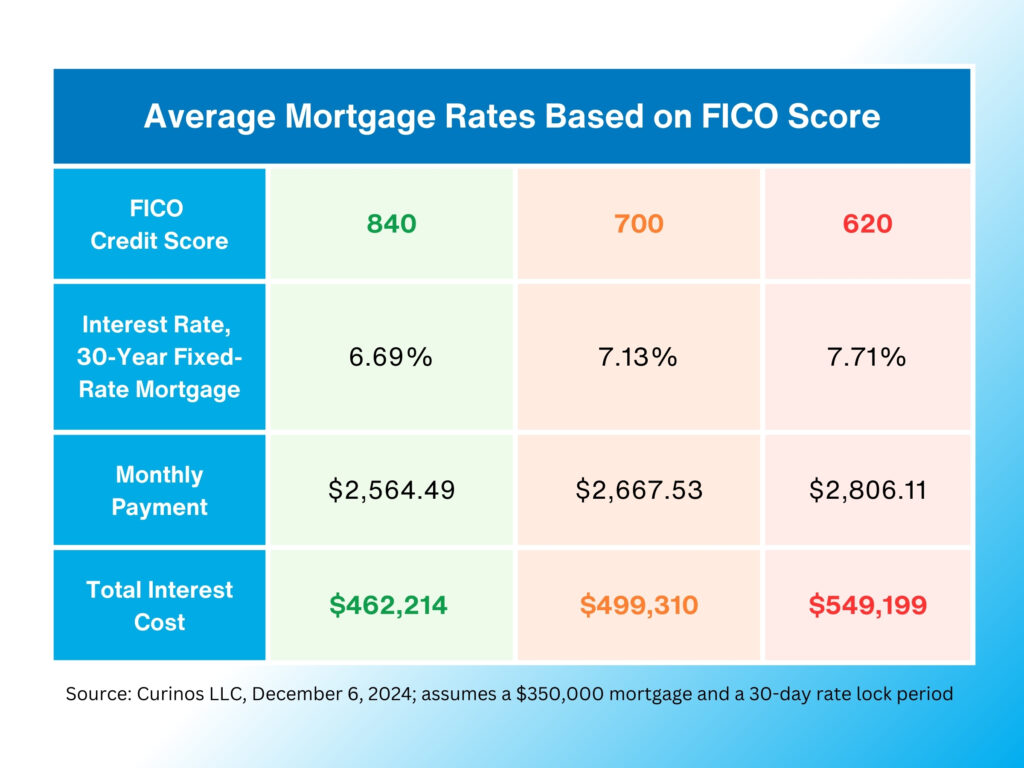

Check out how much you could save on total interest costs depending on your credit score:

The difference between a 620 credit score and a 700 credit score could cost you $49,889! That’s not a number you can turn a blind eye to! Click here for more information about credit scores and how to build your score from zero! For more interactive learning, follow along with the Credit Profile Basics guide provided by the National Financial Educators Council.

1166 Federal Credit Union

Contact Us: Browse our website for more information or contact us at 856-542-9241 to speak to a member of our team. You can also find 1166 on Social Media here:

Instagram: https://www.instagram.com/1166fcu/

Facebook: https://www.facebook.com/1166fcu.org

LinkedIn: https://www.linkedin.com/company/99499168/admin/feed/posts/ Twitter/X:https://twitter.com/1166FCU?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

Follow Us Today On:

Note from AC JosepH Media: If you like this story and others posted on Front Runner New Jersey.com, lend us a hand so we can keep producing articles like these for New Jersey and the world to see. Click on SUPPORT FRNJ and make a contribution that will go directly in making more stories like this available. Thank you for reading!