How to Avoid Holiday Debt and What to Do If You Already Have It

To bargain lovers’ delight, and your wallets fright, it’s the most tempting time of the year to splurge on holiday purchases wrapped in red stickers and limited-time discounts. But without the right shopping strategy, presents won’t be the only thing under the Christmas tree; you’ll find a bundle of debt there, too.

Debt Trends Are Snowballing

One Gallup poll found that American shoppers expect to spend an average of $1,007 on holiday shopping. On top of that, among the 79% of people who spend on gifts or travel, 52% say they don’t plan to pay off their holiday balances in full when bills are due, according to the American Institute of CPAs (AICPA).

Put simply, Americans are planning to take on debt after the holidays when they should be planning strategies to avoid or tackle any outstanding balances. Rather than join the crowd and have a blue Christmas, try these helpful tips to embrace the holiday season without a blizzard of bills.

Strategies to Avoid Debt

If this blog finds you before you’ve pressed “add to cart,” you’re in luck. Keep these strategies in mind to help you avoid debt this holiday season.

1.) Make a List

If it’s good enough for Santa, it’s good enough for you. Before you even step foot into a store or think about clicking on Amazon, make a list of all the loved ones you are buying for and the gifts you want to get them. That way, you can stay on task, unswayed by tempting offers for items you don’t actually need… Grandma wanted a candle warmer, not another “world’s best grandma” mug you bought because it was 50% off.

Stick. To. Your. List.

2.) Secret Santa

So you made a list, and it’s longer than a 39-and-a-half-foot pole. It doesn’t make you a grinch to suggest a Secret Santa gift exchange to friends and family (see what we did there). Trust me, most people will be happy you suggested this option, and here’s why:

Secret Santa is when participants are anonymously assigned one person to shop for, and then everyone reveals their identity when gifts are exchanged. So rather than buying a gift for every person in your friend group, you only have to spend money on one person. This is an excellent gift-giving option because everyone is on board, it’s WAY more affordable, and it’s a fun activity for gatherings. Check out Elfster if you’re looking for a free, digital way to set up your Secret Santa!

3.) Track Everything (Especially your budget)

Did I get Uncle Joe a gift?

Was that gift delivered?

Am I overbudget?

Did I already buy this?

Can I return this?

Replace anxious thoughts with dreams of sugarplum fairies and a debt-free 2026 by keeping track of your holiday shopping.

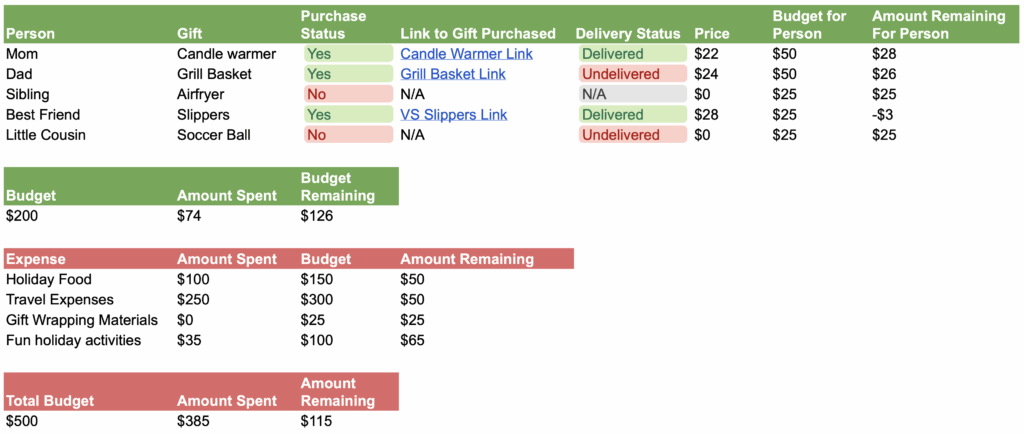

Here’s an example of my Google Sheets tracking template that I legitimately use every year, but you can customize your tracking system however it makes sense for you! I separate my holiday budget into two sections to keep everything organized: one for gifts and one for miscellaneous expenses, such as food, travel, and wrapping materials. With some easy formula inputs on Google Sheets, a tracking system like this will keep you organized without having to do any math! It’s a Christmas miracle!

The moral of the story is to know where your money is going. If this seems like a lot of effort, think about how much more effort it’s going to be to repay a big ol’ pile of debt…enough said!

4.) Try Cash-Only

I love my credit card, you probably love your credit card, and debt loves your credit card even more! It’s so easy to use…until you realize it’s a little too easy and you’ve swiped one too many times, so much so that you can’t afford to pay off your credit card bill. If that’s you, keep the card at home.

Instead, withdraw your shopping budget in cash. You’ll physically see how much money you have left to spend, and it eliminates the risk of overspending or falling into credit card debt.

If this seems like a lot of effort, think about how much more effort it’s going to be to repay a big ol’ pile of debt… anyone else getting deja vu?

5.) Look at Price History

Sales language is meant to be convincing. 60% off…limited time only…BOGO…the list goes on. And while it’s true that Black Friday, Cyber Monday, and regular holiday discounts can save you big time, beware of getting swept away by exciting phrasing. One way to stay grounded is to look at price history and compare prices with other retailers.

Here are some FREE helpful web extensions that can assist with price monitoring, retailer comparison, and coupons:

- Honey – Applies coupons and tracks price drops

- CamelCamelCamel – Tracks Amazon prices

- Karma – Price comparison for clothing retailers

- PriceSpy – Price comparison for multiple retailers

6.) Cash Back or Credit Card Rewards

‘Tis the season to take advantage of credit card cashback rewards! Redeeming cashback or travel points during the holidays can lighten the load of gift buying and traveling. With tons of credit card options out there, especially at 1166 FCU, consider which card works best for you to help you out next year.

7.) Avoid Opening Store Cards

“Would you like to open a store card with us to save 15% off your purchase today?” Ah, the sugar-coated question of cheery Christmastime cashiers.

If you frequently shop at a store that offers year-round benefits and you’re a responsible cardholder, opening a store card may be a beneficial idea. But for many shoppers, store cards are a slippery slope. Most have very low credit limits and very high interest rates. Additionally, the temptation of exclusive rewards, features, sales, and other perks can lead to overspending and debt. Not to mention, the more cards and outstanding balances you have, the harder it is to keep track of your spending.

8.) Create a Holiday Fund

Only 1 in 10 Black Friday shoppers have part of their pay go automatically into a holiday fund. That means 9 in 10 Black Friday shoppers need to change their ways! While it may be too late to save up for shopping sessions this year, now is the time to build helpful savings habits that can eliminate financial stress in the future. Check out 1166 FCU’s Christmas Club savings account, or consider a more high-yield alternative like a money market account or a high-yield savings account.

How to Tackle Holiday Debt

If you’ve already overate and overspent this holiday season, don’t worry, we’re not putting you on the naughty list. Instead, here’s a nice list of ways to consolidate your debt and get back on track for the new year.

1.) Assess and Plan

Which is worse: Grandma getting run over by a reindeer or seeing the damage the holidays did to your wallet? Either way, it’s key to know exactly where you stand. Ask yourself:

How much debt are you in?

How long will it take to pay it off?

Which holiday category cost the most?

How can you avoid this in the future?

Once you have the answers, create a realistic repayment plan. Decide how much you can dedicate to debt each month and whether you need a stronger strategy to get the ball rolling.

2.) Debt Repayment Strategies

If the ghost of 1166 blogs past came to visit you tonight, he’d take you to our deep dive on the snowball and avalanche debt repayment strategies. Here’s a quick breakdown:

The Snowball Method

The snowball method tackles debt balances from smallest to largest. First, you diminish your smallest debt balance until it is paid in full. Then, you roll the money you previously allocated toward that payment onto the next smallest debt you owe. As payments roll over from debt to debt, the amount you put toward each payment snowballs!

The Avalanche Method

This strategy is the opposite of the snowball method. You start by paying off the debt with the HIGHEST interest rate. The same payment rollover principle applies here, but you prioritize interest rates over balances.

And the newest addition…The Snowflake Method

The snowflake method allocates any unexpected income or savings directly to debt repayment. This method should be used in combination with others to speed up the repayment process.

3.) Debt Consolidation Loans

Consolidation is the process of combining multiple things into one, like pouring all your half-used ketchup bottles into a single container to save space in your fridge. For debt, consolidation means combining multiple debts into a single monthly payment, making it easier to manage.

Debt consolidation works best when the interest rate on your new loan is lower than the combined rate of your existing debts. If it’s higher, you could end up paying more interest and taking longer to become debt-free.

Here are some popular debt consolidation options:

Personal Loan

Personal loans are unsecured, meaning lenders take on more risk, so they typically have higher interest rates and lower loan amounts. A strong credit score, however, can help you secure a larger lump sum at a lower rate.

Home Equity Loan

A home equity loan uses your house as collateral to provide a lump sum for debt repayment. Because the loan is secured, lenders face less risk, which usually means lower, fixed interest rates and predictable monthly payments.

Home Equity Line of Credit (HELOC)

A HELOC is a revolving line of credit secured by your home. You can borrow and repay funds as needed, giving you flexibility, though interest rates may fluctuate over time.

Your Holiday Helpers

Whether you’re staying on track for the new year or nursing a post-holiday debt hangover, 1166 FCU’s certified financial counselors and top-notch services can help keep the magic of the season alive, and your finances standing tall like a perfectly decorated Christmas tree.

To bargain lovers’ delight, and your wallets fright, it’s the most tempting time of the year to splurge on holiday purchases wrapped in red stickers and limited-time discounts. But without the right shopping strategy, presents won’t be the only thing under the Christmas tree; you’ll find a bundle of debt there, too.